On occasion, taxpayers may receive either by telephone, mail and/or email, a communication that claims to be from the Canada Revenue Agency (CRA). In all of these cases, any communication that requests personal information, such as a social insurance, credit card, bank account or passport number from a taxpayer is fraudulent.

The communication usually states that this personal information is required so that the taxpayer can receive a refund or benefit payment. Another common technique refers the person to a website resembling the CRA’s. The person is then asked to verify their identity by entering personal information. Taxpayers should not respond to these fraudulent communications.

To better equip taxpayers to identify communications that do not come from the CRA, they should ask themselves the following questions:

- Am I expecting a refund from the CRA?

- Does this sound too good to be true?

- Is the requester asking for information that I would not otherwise include in my tax return?

- Is the requester asking for information that I know the CRA already has on file?

- How did the requester get my email address?

- Am I confident I know who is asking for the information?

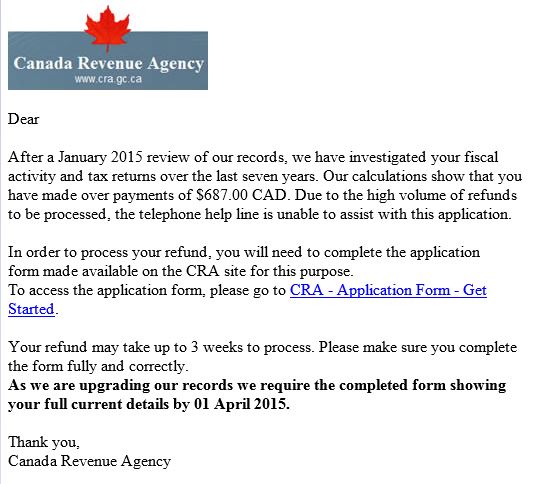

Below is an example of a fraudulent letter that is currently being circulated:

In the event you receive a communication that claims to be from the CRA and you have any doubts as to it’s authenticity, please feel free to contact your Lipton advisor.