The Government of Ontario recently tabled its 2020 Budget.

Highlights are outlined below:

Corporate Tax:

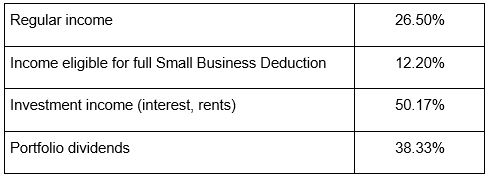

Corporate Tax Rates

No new corporate income tax rate changes were announced in this year’s budget. As a result, selected combined 2020 federal and Ontario tax rates are outlined below:

Employer Heath Tax (EHT)

Private-sector employers paying total remuneration of less than $5 million were previously eligible for an EHT exemption on up to $490,000 of their payroll. In March 2020 the EHT exemption was temporarily increased from $490,000 to $1 million for 2020 and was to expire on January 1, 2021. The 2020 Budget proposes to make the increased exemption permanent.

In addition, employers with annual Ontario payroll over $600,000 are required to pay EHT by way of monthly installments. The government is proposing to double this threshold to $1.2 million, beginning in 2021. Private-sector employers who claim the full exemption will be required to remit EHT installments when they owe more than $3,900 in EHT for the year.

Ontario Research and Development Tax Credit (ORDTC)

The Budget proposes to extend the reporting period to claim an ORDTC. Corporations with tax year-ends from September 13, 2018 to December 31, 2018 would have an additional six months to file a claim; corporations with tax year-ends from January 1, 2019 to June 29, 2019 would have until December 31, 2020 to file an ORDTC claim.

The proposed change parallels the extension of the reporting deadlines for federal scientific research and experimental development claims.

Changes to film, television, media and publishing tax credits were also announced.

Personal Tax:

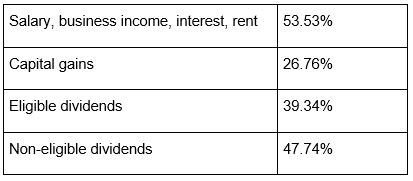

Personal Tax Rates

No new personal income tax rate changes were announced in the Budget.

As a result, the current top combined federal and Ontario marginal tax rates for 2020 will continue as outlined below:

Seniors’ Home Safety Tax Credit

The 2020 Budget proposes a new temporary Seniors’ Home Safety Tax Credit, which is a refundable tax credit for eligible claimants.

The proposed credit would not be dependent on income and could be claimed for eligible expenses by senior homeowners, renters or people who live with relatives who are seniors.

The Seniors’ Home Safety Tax Credit will be equal to 25 percent of up to $10,000 in eligible expenses for a senior’s principal residence in Ontario.

The maximum credit would be $2,500; the $10,000 maximum would be shared by the people who live together, including spouses and common-law partners.

To be eligible, expenses must be paid or become payable in 2021 and must relate to renovations that improve safety and accessibility or help a senior be more functional or mobile at home. Eligible expenses would include:

- Renovations to permit a first-floor occupancy or secondary suite for a senior;

- Grab bars and related reinforcements around the toilet, tub and shower;

- Wheelchair ramps, stair / wheelchair lifts and elevators;

- Non-slip flooring;

- Additional light fixtures throughout the home and exterior entrances;

- Automatic garage door openers; and

- Modular or removable versions of a permanent fixture, such as modular ramps and non-fixed bath lifts.

Individuals would be able to claim the credit if the improvement was made to their principal residence, or to a residence that is reasonably expected to become their principal residence within 24 months after the end of 2021.

Other Measures:

Business Education Tax (BET)

To reduce regional tax inequities and improve business competitiveness, the government proposes to reduce all high BET rates to a rate of 0.88 percent for both commercial and industrial properties beginning in 2021, a reduction of 30 percent for businesses currently subject to the highest BET rate.

Property Tax Relief for Small Businesses

Beginning in 2021, municipalities would be able to adopt a new optional property subclass for small business properties. The small business property subclass will allow municipalities to target tax relief by reducing property taxes to eligible small business properties. The Province will also consider matching municipal property tax reductions to provide further support to small businesses.

For more information, please contact your Lipton advisor.